Critical Illness and Surgery: Best Health Insurance Policies

Due to the sedentary lifestyle of people, health issues are on the rise, leading to physical, emotional, and financial stress. Critical illnesses and surgeries, in particular, can be financially overwhelming due to their expensive treatments and prolonged care. Having a robust health insurance policy is essential to provide financial security and ensure access to quality healthcare.

This article explores the importance of critical illness and surgery insurance policies and highlights some of the best health insurance company available.

Understanding Critical Illness and Surgery Insurance Policies

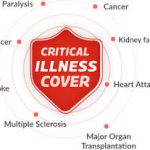

Critical illness insurance provides coverage for life-threatening diseases or conditions such as cancer, heart attack, stroke, kidney failure, and organ transplants. These policies pay out a lump sum amount that can be used for medical treatments, rehabilitation, or even for non-medical expenses like loan repayments or loss of income.

On the other hand, surgery insurance policies cover expenses related to surgical procedures. These include hospitalisation charges, doctor fees, pre-and post-surgery care, and related medical expenses. Many comprehensive medical insurance plans combine coverage for both critical illness and surgeries, offering all-around financial protection.

The primary advantage of critical illness and surgery insurance is that they help reduce the financial burden on policyholders and their families during times of medical emergencies. This allows individuals to focus on recovery without worrying about the costs.

Key Features of Health Insurance Policies for Critical Illness and Surgeries

When choosing a health insurance policy, it is crucial to look for the following features:

Coverage for Major Critical Illnesses: Ensure the policy covers a wide range of critical illnesses such as cancer, heart ailments, strokes, and neurological diseases.

Surgical Coverage: Opt for policies that include a variety of surgical procedures, from minor surgeries to complex ones like bypass surgery and organ transplants.

Sum Assured and Payout: Critical illness policies typically offer a lump sum payout, which can be used for both medical and non-medical expenses. The sum assured should be substantial to cover the costs of expensive treatments.

Cashless Hospitalisation: Many insurance providers offer cashless hospitalisation in a network of hospitals, saving policyholders the hassle of upfront payments.

Pre- and Post-Hospitalisation Coverage: Look for policies that reimburse expenses incurred before and after hospitalisation, such as diagnostic tests, medications, and follow-up consultations.

Renewability and Policy Tenure: Choose a policy that offers lifetime renewability so that you remain covered for critical illnesses and surgeries in your later years when risks increase.

Premium Waiver: Some policies waive future premiums if the policyholder is diagnosed with a critical illness during the policy term.

Factors to Consider Before Choosing a Policy

When selecting a health insurance policy for critical illness and surgeries, consider the following factors:

Your Health Condition and Family History: If you have a family history of critical illnesses like cancer or heart disease, opt for a policy with higher coverage.

Age and Lifestyle: Older individuals and those with unhealthy lifestyles may require policies with comprehensive coverage and higher sum insured.

Policy Exclusions: Review the list of exclusions, including pre-existing diseases, certain surgeries, or waiting periods for specific illnesses.

Affordability: Compare premiums and benefits across different insurers to choose a policy that suits your budget.

Insurer’s Claim Settlement Ratio: Opt for an insurance provider with a high claim settlement ratio, as this indicates reliability and efficient claim processing.

Additional Riders: Look for add-on riders such as accidental death benefits, income replacement benefits, or wellness programs for added protection.

Why Critical Illness and Surgery Insurance is Essential

With the rising cost of healthcare, critical illness and surgery insurance has become a necessity rather than a luxury. The cost of treating diseases like cancer or undergoing major surgeries can drain your savings and put your family under financial stress. Health insurance policies with critical illness and surgery coverage ensure:

Financial Security: They provide a safety net, covering expensive medical treatments and surgeries.

Access to Quality Healthcare: Policyholders can avail of the best treatments without compromising on quality due to cost concerns.

Peace of Mind: Knowing that you are covered during medical emergencies allows you to focus on recovery and well-being.

Wrapping Up

Health is wealth, and ensuring financial protection during critical illnesses and surgeries is vital. Investing in a health insurance policy that offers comprehensive coverage for critical illnesses and surgeries can safeguard your future. Policies like that provided by Niva Bupa are among the top choices for individuals seeking financial security during medical emergencies. Compare the features, benefits, and costs of these policies to choose one that best meets your needs. A well-chosen health insurance policy will not only protect you but also provide peace of mind to you and your loved ones during challenging times.